riverside county sales tax calculator

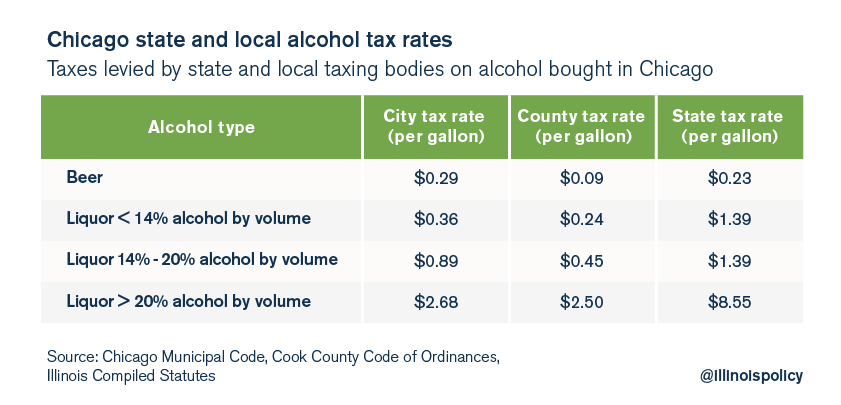

The Chicago sales tax rate is. Heres how Cook Countys maximum sales tax rate of 115 compares to other counties around the United.

Riverside County Ca Property Tax Calculator Smartasset

The 2018 United States Supreme Court decision in South Dakota v.

. The minimum combined 2022 sales tax rate for Chicago Illinois is. On top of the states minimum sales tax individual counties and cities also charge a sales tax. 2020 rates included for use while preparing your income tax deduction.

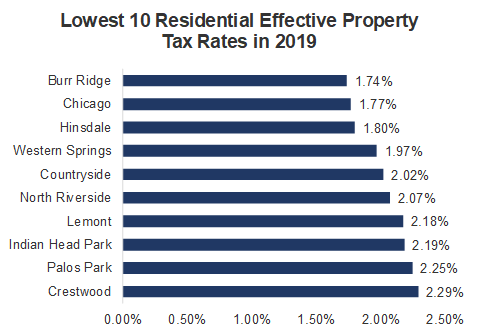

Click here for a larger sales tax map or here for a sales tax table. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Automating sales tax compliance can help your business keep compliant with changing sales.

Riverside CA Sales Tax Rate. That is nearly double the. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

This is the total of state county and city sales tax rates. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. The Illinois sales tax rate is currently.

The Clark County sales tax rate is. Sales Tax Calculator Sales Tax Table. The County sales tax rate is.

San Bernardino CA Sales Tax Rate. Has impacted many state nexus laws and sales tax collection requirements. County Sales Tax Rates.

Some cities and local governments in Cook County collect additional local sales taxes which can be as high as 35. New Jersey has state sales tax of 6625 and allows local governments to collect a local option sales tax of up to NAThere are a total of 308 local tax jurisdictions across the state collecting an average local tax of 0003. TAX DAY NOW MAY 17th - There are -470 days left until taxes are due.

Sacramento CA Sales Tax Rate. The county has a sales tax of 95. The property tax rate in the county is 078.

Start filing your tax return now. As an example consider Los Angeles County. 5 at midnight and ends at midnight on Sunday Aug.

The annual sales tax holiday begins Friday Aug. The latest sales tax rates for cities in California CA state. Only about a quarter of the cities in California actually charge a sales tax of 725.

A county-wide sales tax rate of 175 is applicable to localities in Cook County in addition to the 625 Illinois sales tax. Income Tax Calculator. Within the county a handful of cities charge a higher sales tax.

Rates include state county and city taxes. Combined with the state sales tax the highest sales tax rate in New Jersey is 8625 in the. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

Cook County collects on average 138 of a propertys assessed fair market value as property tax. To review the rules in Nevada visit our state-by-state guide. This is the time to take advantage of this.

Transfer Tax In Riverside County California Who Pays What

Riverside County Ca Property Tax Calculator Smartasset

Food And Sales Tax 2020 In California Heather

California Sales Tax Rates By City County 2022

Understanding California S Sales Tax

Property Tax Village Of River Forest

Greater Dayton Communities Tax Comparison Information

A Golden Opportunity California S Budget Crisis Offers A Chance To Fix A Broken Tax System Tax Foundation

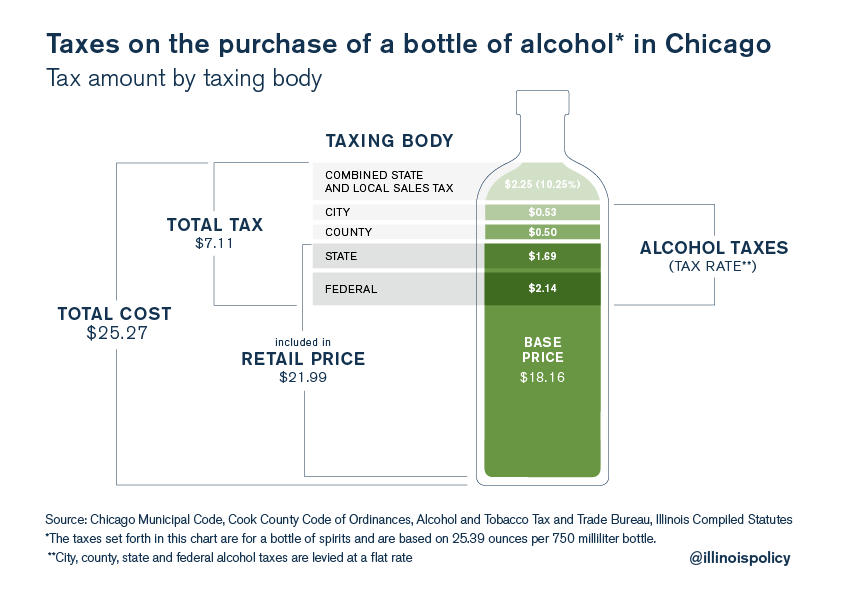

Chicago S Total Effective Tax Rate On Liquor Is 28

How To Calculate Cannabis Taxes At Your Dispensary

Chicago S Total Effective Tax Rate On Liquor Is 28

Understanding California S Property Taxes

California Sales Tax Guide For Businesses

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

California Sales Tax Small Business Guide Truic

Understanding California S Property Taxes